Recently, the FracTracker Alliance has compiled a national well file of nearly 1.7 million active wells in US, including all onshore production, service, injection, and disposal wells that have not yet been permanently plugged. All of this activity makes the United States is a net producer of natural gas, but in May of this year, the country still imported an average of 4.6 million barrels per day (731 million liters), according to the US Energy Information Administration (EIA). It is unclear if true energy independence – a popular selling point of carbon extraction industries – is even possible for the United States without a major shift in the country’s energy mix.

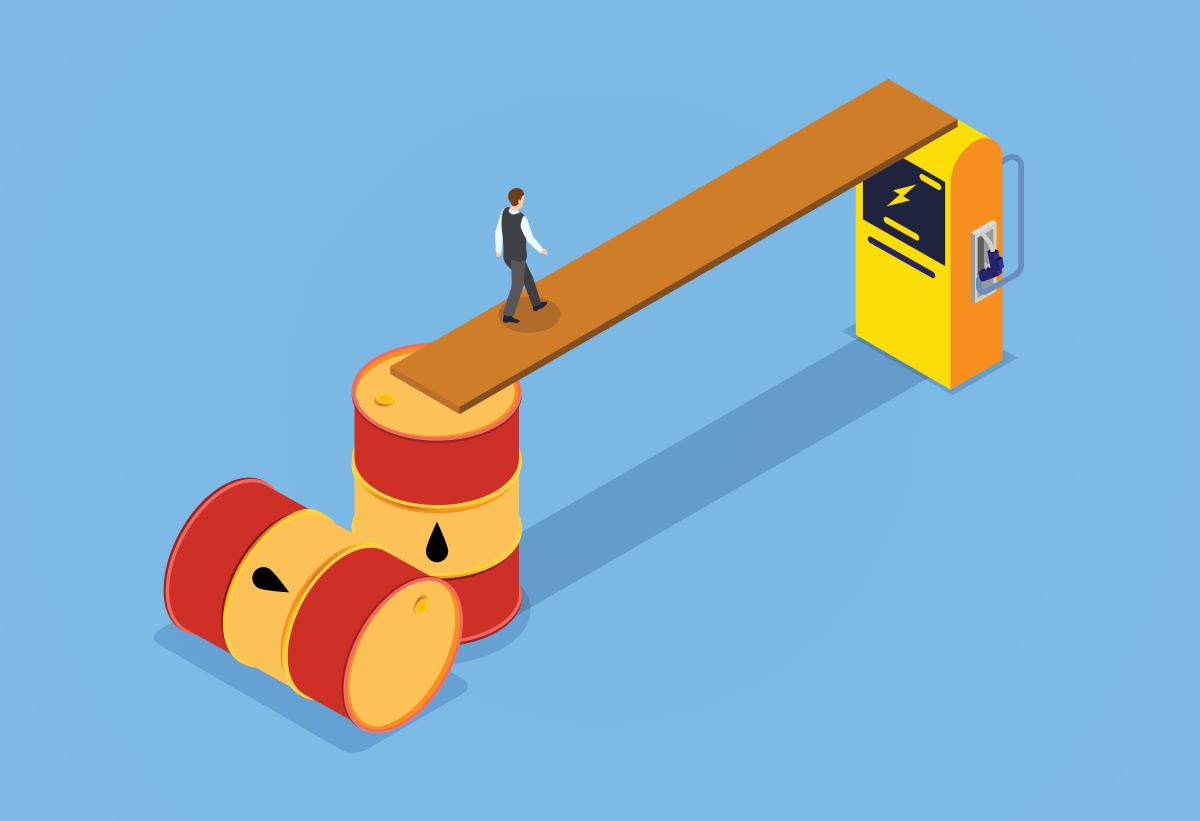

Price of Oil and Drilling Activity

According to the EIA, the highest spot price for Cushing crude oil was $145.31 per barrel on July 3, 2008. The price crashed soon afterward, as a part of the global recession that was generally considered to be the worst – at least in the United States – since the 1930s. The price of Cushing crude plummeted to $30.28 on December 23, 2008, losing almost four fifths of its value in less than six months. The price did not cross the $100 threshold until March 2, 2011, then remained relatively stable for several years.

Starting in July 2014, the price of crude once again began to plummet, but not because of a general shrinking of the economy. This time around, the culprit seems to have been a self-inflicted wound; an oil glut caused by increased production in the United States from shale plays, notably the Bakken and Eagle Ford. OPEC (Organization of the Petroleum Exporting Countries) nations maintained production levels despite the lower costs in a move to burden the North American production, which is more expensive to produce.

OPEC’s strategy has been successful so far. The number of rotary drill rigs in operation has plummeted from a recent high of 1,930 in September 2014 to 1,109 in March 2015, the most recent date available. Over 150,000 oil sector jobs were lost through May 2015 worldwide, with the United States being hit the hardest.

Many industries are subject to boom and bust cycles, but for the oil and gas industry in the United States, the swings can be rather dramatic.

Other Kinds of Data

In the United States, data for the oil and gas industry are maintained by the 35 states where extraction is occurring, making the task of understanding the breadth and depth of industry a challenging one. Many residents are less concerned with the whims of the global petroleum market, and more concerned about their own communities. They may want to know about the placement of a new well pad, the history of violations for an older one, whether there are pipelines buried on property that they purchase, whether an impoundment contains fresh water or flowback fluid, or whether the noxious compressor station down the road has been inspected lately. Others may wish to monitor certain aspects of the industry, such as water usage during drought, surface or drinking water contamination, deforestation and forest fragmentation, or the risk of pipeline or train explosions in their area. Still others may simply want to know who owns the mineral rights to their properties.

Some states are better than others about providing answers to these kinds of questions. The largest oil producing state, Texas, charges money for most of their well data, and their data can at best be described as “user unfriendly” once the purchase is made (See Figure 2). North Carolina, which has barely any oil and gas resources, doesn’t charge for their data – they simply don’t make it available on their website, nor did they respond to any of our queries.

A small sample of a dataset purchased from the Texas Railroad Commission, which oversees oil and gas operations in that state. The data is poorly formatted for analysis, with unexplained alphanumeric sequences.

Other states put more effort into data transparency. In a collaborative project with the National Resources Defense Council earlier this year, we at FracTracker found that there were only three states that publish violation data for example – Colorado, Pennsylvania, and West Virginia, to give credit where it is due. Pennsylvania is unique in specifying the various types of solid and liquid waste, as well as the destination and method of that waste’s disposal, although the data are self-reported by the industry and not verified by the state’s Department of Environmental Protection.

Other types of data are off limits, purportedly for national security purposes. This list includes detailed pipeline locations (although “zoomed out” data is available from the Pipeline and Hazardous Materials Safety Administration), compressor station locations, and oil train schedules and manifests. All three of these examples are considered to be midstream activities; it seems to be acceptable for the public in the United States to know where the oil and gas was extracted from and where its destination is, but not how or when it got there.