Despite an 11% dip in global investment in 2013, an abundance of opportunities in new markets, new technologies and new sources of capital all signal brighter times ahead, according to EY’s latest quarterly Renewable energy country attractiveness index (RECAI).

Gil Forer, EY’s Global Cleantech Leader comments: “The 2013 fall in global investment reflects another challenging year for the renewables sector, with policy uncertainty in particular reducing investor appetite across many markets. However, it also reflects a maturing sector, with falling technology costs filtering through to lower investment requirements: increasing the dollar power per megawatt. We must now therefore focus on what needs to be done to maximize investment and deployment in light of the fact renewable energy is becoming increasingly cost competitive.”

China closed the gap on the US at the top of the index, installing a record-breaking 12GW of solar capacity in 2013 and ramping up its consolidation effort to accelerate market recovery. Germany remains in third place, but lost ground following the announcement of subsidy cuts and watered-down renewables targets by the new coalition government. Rapid solar market growth and a burgeoning offshore sector helped Japan to replace the UK in fourth place, while the UK continues to be hampered by political infighting and mixed policy measures.

Prolonged energy strategy consultation and anti-renewables legislation have resulted in ranking falls for France and Australia respectively, while ambitious targets and a series of large-scale project announcements have seen India jump to seventh place. Competitive bidding trendsetters Brazil and South Africa have also risen in the index thanks to a plethora of new projects awarded in 2013 auctions.

Looking ahead, resilience, efficiency and effectiveness, technology beyond generation, new markets and innovative financing have been identified as fundamental to industry growth in 2014.

Governments and business will need to consider the value put on energy sector resilience, in light of the industry’s historic inability to absorb economic, political and environmental shocks. Governments should aim to depoliticize the energy debate in order to support stable and long-term policy measures, undertake a transparent and objective assessment of the value of energy to determine the most resilient energy mix, and embrace centralized energy planning to counter the uncertainty of the market while still fostering private sector participation.

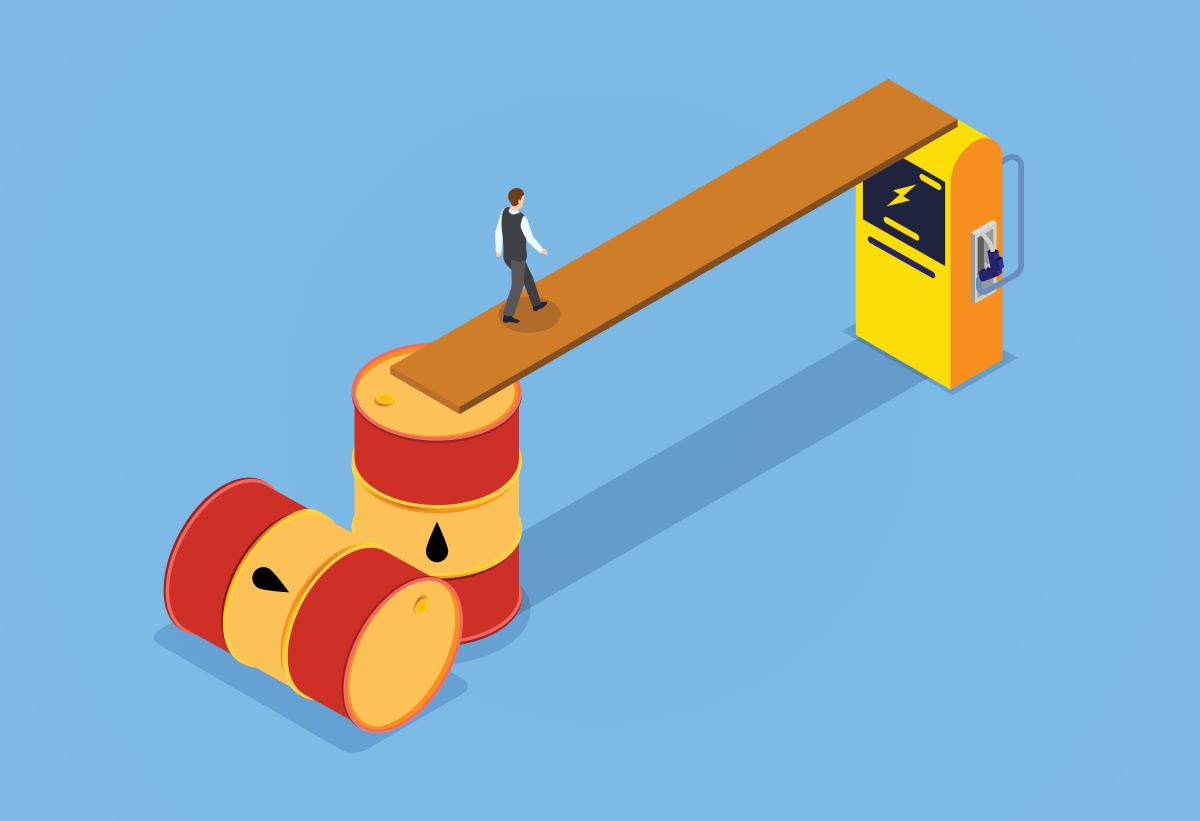

Business also has a role to play in addressing its own energy risks, such as commodity price exposure, business continuity and regulatory compliance. This should prompt an increased focus on energy mix optimization that transcends the politics of the boardroom and identifies opportunities for reduced energy consumption and direct generation or procurement of renewable energy.

Efficiency and effectiveness are critical. A stronger focus on asset optimization and identifying new ways to extract value or reduce costs is also anticipated in 2014. Ben Warren, EY’s Global Cleantech Transactions Leader comments: “In short, “efficiency” and “effectiveness” need to be this year’s buzzwords. The market should be setting its sights on: value chain integration, consolidation on a global scale, repowering, transaction and capital efficiencies and technology improvements. Renewable energy is now a truly global market, and stakeholders must develop a global strategy and a global supply chain, be flexible to market changes, and be willing to go in search of new markets.”

Deployment challenges in markets such as China, Japan, Germany and South Africa during 2013 have highlighted the need for more robust transmission infrastructure and efficient distribution channels. More resource and investment is required in grid management, digitalized supply and demand management, distributed applications and the commercialization of storage technology, if the sector is to address transmission bottlenecks and intermittency challenges.

Forer comments: “Innovation in non-generation infrastructure and technology will not only drive efficiencies and boost deployment, but also represents a significant investment opportunity across both developed and emerging markets. The digitalization of energy in particular will create a revolution that will have significant social, economic and environmental impact.”

Emerging markets will also continue to play a critical role in shaping the renewables landscape, now attracting around half of new investment in the sector. Investors will increasingly focus on those markets characterized by economic and energy demand growth, significant natural resource, an energy security imperative and an absence of infrastructure legacy. Markets to watch in 2014 include Ethiopia, Kenya, Indonesia, Malaysia and Uruguay.

Also, following the urgent call for new sources of capital and new investment vehicles in 2013, the theme of innovative financing will remain at the fore in 2014.

Warren comments: “As a capital intensive sector, accessing diverse pools of capital is critical for the future of the industry. Renewable energy financing is no longer just the remit of banks and utilities. There are deep pools of capital to be tapped but creative solutions and new conduits must be identified to open up the finance markets once again and bridge the gap between investors and projects. The markets that will rise up the RECAI in 2014 are those that embed renewables as a core part of their energy strategy; to stimulate economic growth through addressing the fundamentals of energy security and low cost energy generation.”