The most rational solution to encourage the use of renewable energy, which in Italy as in Germany is financed by energy bills, would appear to be a redistribution of the costs based on volumes of carbon dioxide emissions: a carbon tax on direct fuel use.

For simplicity’s sake, assuming that the carbon tax is limited to the electrical sector, it would eliminate from energy bills the component which finances incentives for renewable energy (“A3”, in Italy), in exchange for a significant increase in the “energy component”: those burning coal or gas would therefore need to raise their prices to cover the carbon tax.

With suitable measures (including a “windfall tax” on renewable energies to which incentives have already been applied, to offset improper returns due to increased wholesale prices), the net effect for users would be positive for two reasons: 1) producers of carbon-intensive fuels would not be able to offload the entire tax on the sale price, as they would risk losing their market share to carbon-efficient competitors; 2) the carbon tax would also affect distributed generation from fossil fuels, thereby increasing the tax basis (cogeneration would in any case be at an advantage, due to its efficiency).

In actual fact, limiting the carbon tax to the electrical sector would not make any economic sense, and the figures involved would be such as to move the Italian wholesale situation yet further away from any hypothesised integration with the European markets.

The benefit for electricity users would instead be greater if the carbon tax were calculated to finance all forms of incentives (electrical and thermal renewable energies, and energy efficiency) and were distributed across all direct fuel uses, redirecting efforts towards thermal and transport uses, rather than focusing on electrical utilities when the positive external effects are widespread.

In the end, the carbon tax would be a way of reducing bills, but through a redistribution of costs to the fossil-fuel industry rather than the new generation of electrical consumers.

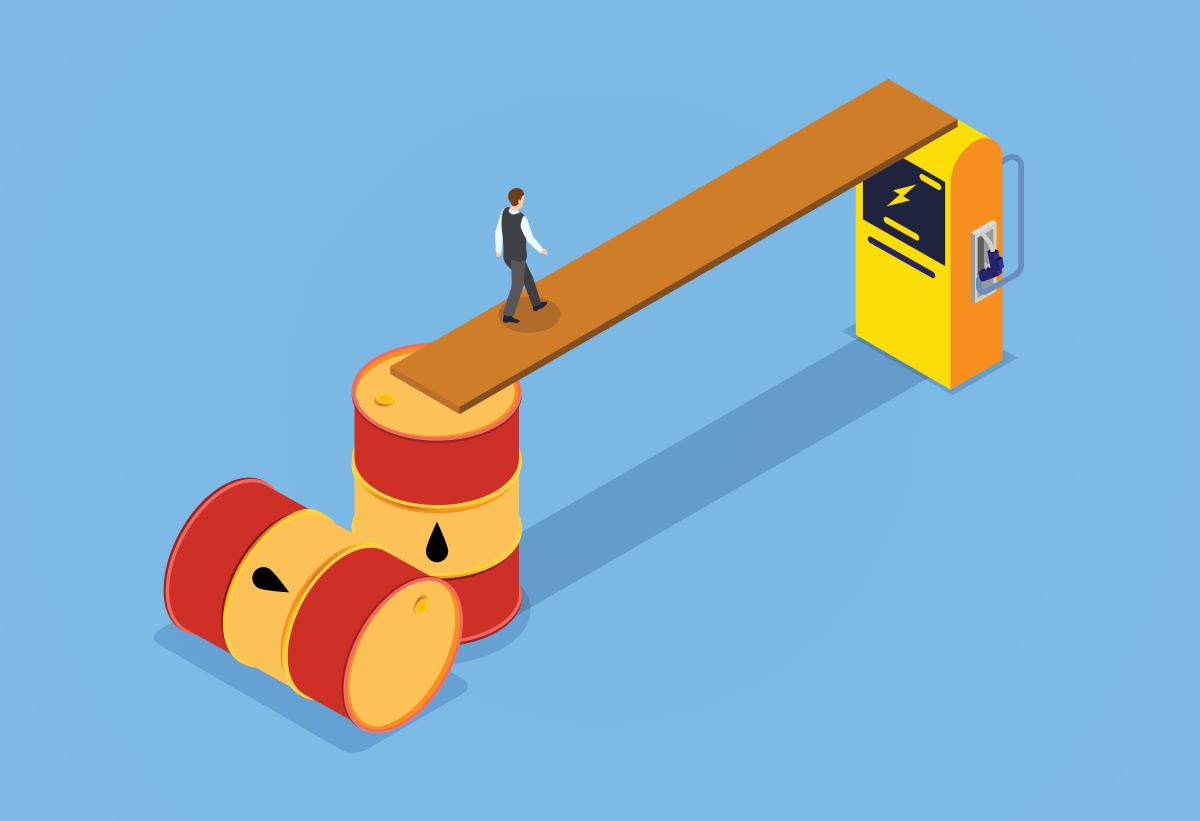

Moreover, by incorporating the costs of decarbonisation into the wholesale price of energy, this would be an economically rational way of promoting gas over coal (going against the envisaged capacity market scheme), as well as electricity (which is generally more efficient and cleaner) rather than the direct use of fossil fuels.

It is important to note that the carbon tax is a complex provision, which will be beneficial for some and detrimental to others, and it involves some important critical issues, ranging from the impact on heating costs for families to a potential superimposition with the ETS [Emissions Trading System], which is prohibited in the draft European Directive on the taxation of energy products. But the fact that the carbon tax is basically lacking from the energy policy debate, with its constant solutions and shaky hypotheses, is baffling.